Composability 2025: Shifts in Martech Stack Gravity

In 2025, the gravitational centre of the martech universe is undergoing a quiet but powerful realignment. While some platforms remain steadfast, others are receding—or even collapsing under their own weight…

Topics

What to Read Next

- Webflow, Google Ads Launch Integration for Smarter Campaign Performance

- HeyMarvin Unveils Agentic Ask AI for Customer Research

- Consensus, Gong Partner to Embed Demo Automation into Sales Workflows

- Conquer Launches Voice Plus, Mobile-First Field Sales App

- AirOps Launches Page360 to Unify SEO and AI Search Signals

B2B stacks modularise: CRM holds firm, MAP recedes, and custom-built platforms rise. In B2C, CDPs unbundle as MAPs and CDWs take centre stage.

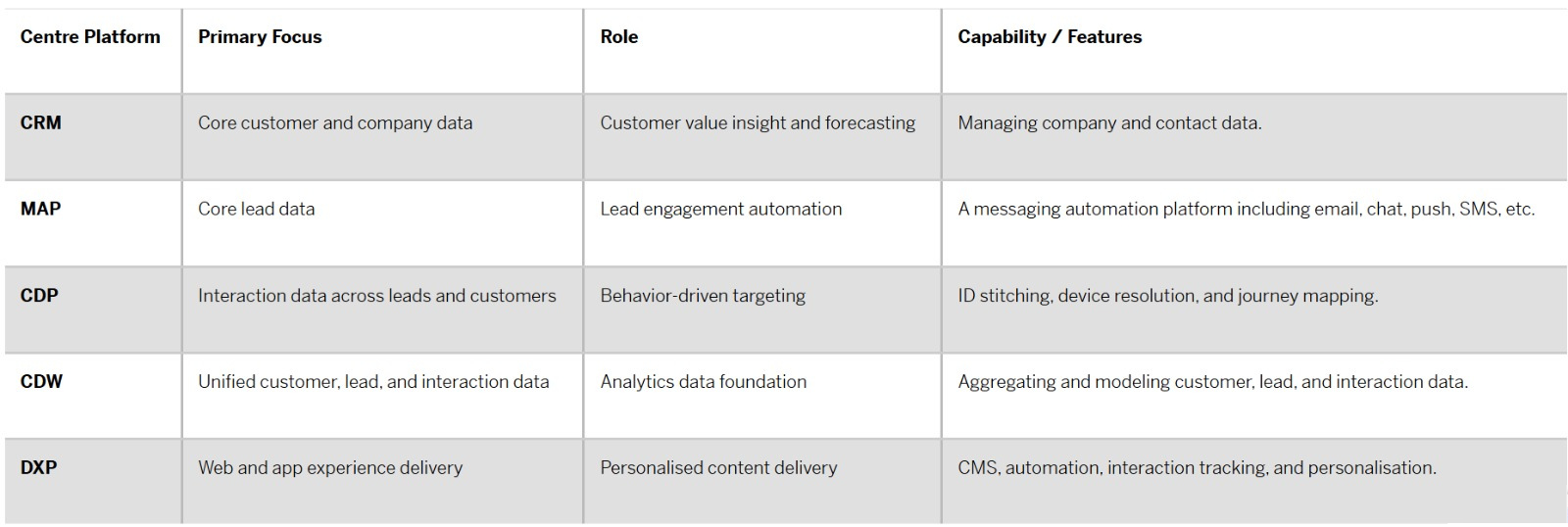

We revisited a key question from our Martech Composability Survey, originally featured in the State of Martech 2024 report. We asked marketers which platform they considered to be the “centre” of their martech stack—the one around which most marketing activities are organised and orchestrated. In 2025, we posed the same question again to see how the centre of gravity in martech stacks has shifted.

Martech stacks function like solar systems, with different layers of platforms orbiting around a central core. At the centre are the “Sun” platforms, which anchor the stack. Orbiting around them are the “Planets,” or orchestration platforms, and the “Moons,” or activation platforms. This structure ensures that the entire stack operates as a cohesive system, where each layer builds on the stability and intelligence of the one before it.

In our 2024–2025 composability survey, we found that regardless of which platform was identified as the centre, 72% of respondents reported that 50% or more of the rest of their martech stack is integrated with it. Nearly a third (32.1%) said that more than 80% of their martech stack is integrated with their centre platform.

In general, there were not many shifts to mention, until we explored the differences between B2B and B2C. Across industries, we see stacks gravitating toward different centre platforms—each with its own core competence that is essential in the martech architecture.

ALSO READ: 15,384 Tools in Martech 2025: Balancing Boom and Bust?

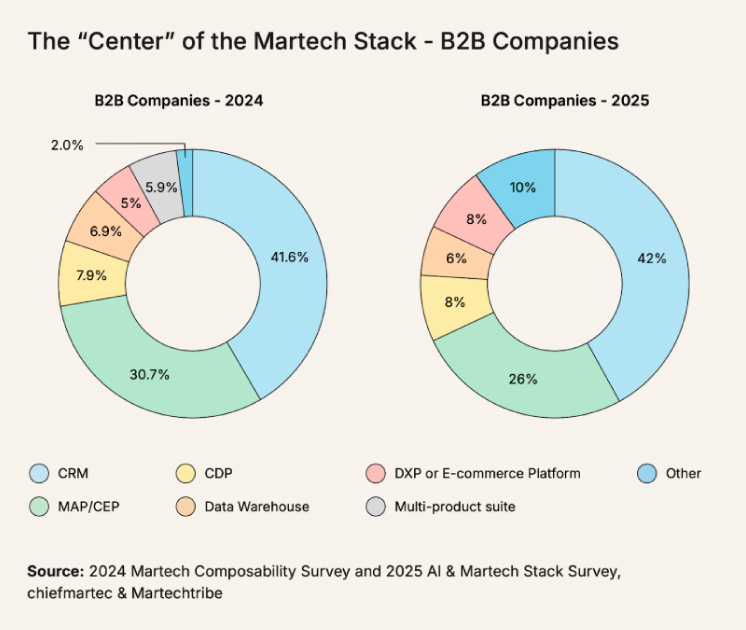

B2B Results: 2024 vs 2025

B2B marketers reported only two changes in what they consider the “centre” of their martech stack. Before we mention the two changes, it is important to emphasise that CRM remains the clear leader, rising marginally from 41.6% in 2024 to 42% in 2025. The role of Cloud Data Warehouses (CDWs) and Customer Data Platforms (CDPs) remains relatively small as central platforms, staying nearly flat at 6% and 8%, respectively.

The first change is that the role of Marketing Automation Platforms (MAPs) dropped from 30.7% to 26%. Digital Experience Platforms (DXPs) likely absorbed some light automation capabilities from MAP, as they increased from 5% to 8%. But the big change is that custom-built or “other” platforms jumped significantly—from 2% to 10%—a fivefold increase in just one year. What is happening? That is a major shift toward composability.

This shift toward composability reveals a deeper rethinking of how B2B marketers architect their stacks. CRM continues to serve as the central platform because it houses all core customer and company data. It is often linked to ERP systems to track transactional value and support forecasting. Its centrality reflects the growing alignment between marketing, sales, and finance.

Meanwhile, the decline of MAP as a centre platform suggests its role is becoming more tactical, focused on executing flows of messages to leads rather than orchestrating the entire stack. Some of this orchestration is now handled by DXPs, but the real story is the rise of custom-built centres. In this modular future, CRM remains the anchor. Will orchestration continue to shift from MAP to custom-built hubs that integrate data, automation, and content in more flexible ways?

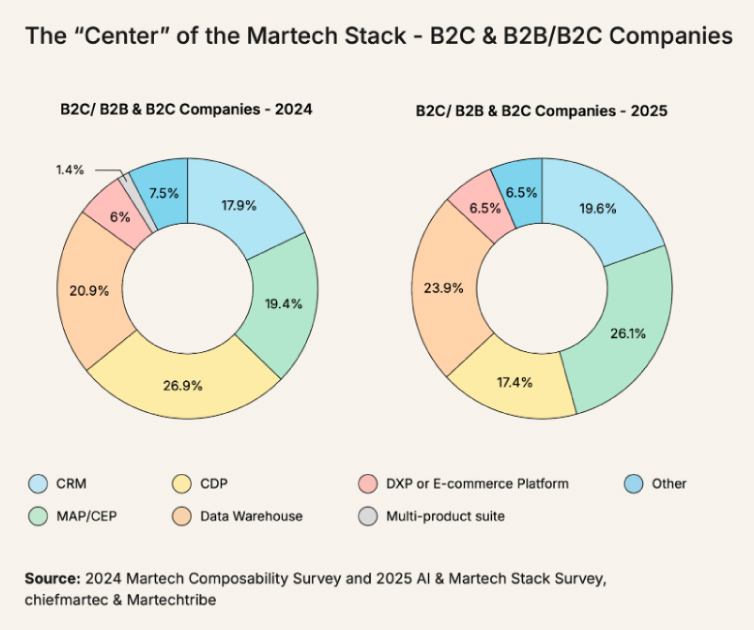

B2C + B2B2C Results: 2024 vs 2025

In the 2025 survey, the most dramatic changes came from B2C and B2B2C companies. Customer Data Platforms (CDPs) were the leading centre in 2024 at 26.9%. In 2025, they dropped sharply to 17.4%—a fall from first to fourth place.

Meanwhile, Marketing Automation Platforms (MAPs) surged from 19.4% to 26.1%, becoming the new front-runner. Cloud Data Warehouses (CDWs) also rose from 20.9% to 23.9%, overtaking CDPs in the process. CRM saw a modest increase from 17.9% to 19.6%, while only 8% of pure B2C businesses consider CRM to be their central platform.

This year-over-year shift reflects significant disruption at the centre of B2C-oriented martech stacks. The fall of CDPs is likely driven by market consolidation and the rise of composable alternatives. A wave of CDP acquisitions took place over the past year and is probably the most talked-about example of this trend. ActionIQ, Lytics, and mParticle were some of the headline cases.

ALSO READ: Media Waste Isn’t an Accident — It’s a Choice

Several of these acquisitions were strategic moves to embed CDP capabilities more natively into customer engagement platforms (CEPs). This supports more unified marketing campaigns and better customer experience management, especially as these platforms adapt to AI-driven use cases. But not all acquisitions were positive stories.

Rather than relying on a single off-the-shelf CDP, many companies now prefer what some call composable CDPs. These are not individual tools but modular architectures built on top of cloud data warehouses such as Azure, AWS, and Google Cloud. They assemble best-of-breed tools like Fivetran for data ingestion, DBT for modeling, and Hightouch for activation. In doing so, they replicate and even exceed the functionality of traditional CDPs. They are designed for flexibility, scalability, and seamless integration with modern data stacks.

It appears that brands are now distributing CDP capabilities between upstream data infrastructure (such as CDWs) and downstream engagement platforms (such as MAPs and CEPs). The rise of MAPs and CDWs highlights a reorientation of the stack around platforms that can either drive real-time engagement or support AI-ready modeling and segmentation.

It is worth noting that in pure B2C businesses, this trend is even stronger. 92% reported having a martech-integrated warehouse or lakehouse. Pure B2C companies are more likely to cite a marketing automation (MAP) or customer engagement platform (CEP) as the centre of their stack (39%).

A CDP like Hightouch has pivoted to fully composable. This means not only offering modular architecture but also allowing companies to select subsets of capabilities, such as building audiences, reverse ETL, syncing data, identity resolution, collecting data, and campaign intelligence, with even composable pricing models.

What this tells us about the architecture is profound. The gravitational “centre” in B2C stacks is shifting. MAPs are evolving from simple messaging engines into orchestration layers that coordinate cross-channel experiences. CDWs are emerging as the true system of record for both customer and lead data—a foundation typically owned by IT but increasingly accessed by marketing. B2C and B2B2C organisations are clearly moving toward composable architectures.

ALSO READ: 25 Martech Innovators Injecting Agentic AI into the Suite