15,384 Tools in Martech 2025: Balancing Boom and Bust?

Martech 2025 reveals 15,384 tools, a 9% growth masking a triple-threat landscape of boom, bust, and balance. Discover the surprising truth behind 1,211 tool removals, the genAI wave, and the silent rise of Product Management.

Topics

What to Read Next

- Stravito Introduces Deep Research Agent in AI Assistant

- StackAdapt Partners with Experian to Boost First-Party Data Activation

- Later Introduces Later 360, a Unified Reporting Suite

- Audion Unveils Audion AI to Deliver Outcome-Driven Audio Advertising Campaigns

- Ramco Systems Launches Chia, a Conversational AI Agent

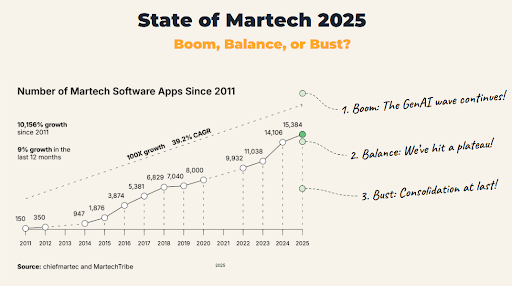

If you thought martech in 2024 was crazy, 2025 brings mixed signals, if not stark contrasts. After the genAI meteorite hit planet Martech in 2024, it might seem like balance has returned, but only on the surface. 2025 shows a smooth 9% growth rate.

The kind of growth we’ve grown used to over the past 13 years. But this year wasn’t quite the business-as-usual growth story. There’s more happening under that surface.

Back to The New Normal?

If we’re “back to normal,” it’s a new kind of normal. The 2025 data tells a richer story. The returning question each year is whether the vendors on the landscape boom, balance, or bust.

Yes, there was growth. Again, we saw a huge flood of new tools. We reviewed 11,133 candidate vendors, of which 2,489 made it to the landscape, that’s 78% of the 2024 total. If you think that’s high, last year the pile was even bigger: 12,919, representing 117% of the year before. But in 2023, the pile was “only” 7,801. So yes, the boom continues. The question now: Did genAI cause it?

But then, 1,211 tools were removed. That is the highest number in the past three years. This raises several questions about their profile. Why were they removed? Were they acquired, or did they go bust? Were they hyped genAI tools that didn’t survive, or older ones that became obsolete? Were they low quality, or did even high-quality tools fail to keep up?

And then there’s a third angle. If you think boom and bust happen simultaneously are mixed signals, you are in for a surprise.

We discovered one martech category that completely ignored boom, balance, and bust. Product Management took its own unique growth path to stardom. Because it didn’t follow the pattern of dramatic rise or fall, it might look like balance, but that’s deceiving. When we stepped back and looked across ten years of martech data, we finally saw it hiding in plain sight. Product Management tools help teams manage product lifecycles. We’ll explore why their role has become so important in these times of low code and AI.

We may conclude that the landscape was hit by all three powerful forces at the same time. 2025 didn’t deliver a single storyline. It delivered three contrasting ones. Martech is never done. Not in your company, and not in the market. Martech continues to evolve. We have to stay sharp.

The GenAI Boom Continues

Wait! Not so fast. Sure, there was a flood of new tools. But we can’t call it a genAI boom without also looking at the other side of the coin: the bust. Maybe more genAI tools were removed than added? So, if we take a look at the 1,211 tools removed, let’s align our gut with the data and see which common assumptions we need to dismantle.

“Ah, I see. Those hyped genAI tools went bust.”

Not quite. More than half (56%) of the removed tools were founded between 2010 and 2020. 93.8% of the removed tools were older than five years, founded before 2020. GenAI only started breaking through in 2022. So no, these weren’t failed genAI experiments. These weren’t overnight launches. Most had been around for years. Many simply ran out of runway. As with many small businesses, cash flow remains a killer. No more funding, no more growth, no more time.

“Ah, I see. All that Content AI went bust.”

Actually, content AI is still booming. In content marketing, 279 new tools were added, while only 140 were removed. In video marketing, 141 were added and just 31 removed.

“Ah, I see. All those tools were acquired.”

Not really. Mergers and acquisitions didn’t drive most removals. The data shows 84% of the tools simply went out of business. Only 10.2% were merged or acquired. Another 5.8% pivoted to other industries, like fintech or edutech, or shifted their business model (e.g., from software to agency services). Most tools weren’t bought; they became unnecessary or were outperformed by newer (genAI-powered?) solutions.

“Ah, I see. The low-rated ones went bust.”

Not so fast. Here’s the twist: 52% of the removed tools had user ratings above 4.5 on G2. In fact, 84.8% scored above 4.0. That’s not just a decent rating, that’s beloved by their users.

“Ah, I see. The flood of new tools came with low quality.”

The opposite is true. The flood of tools over the past decade hasn’t dragged quality down. It pushed it up. The younger the tool, the higher the rating (0.68 percentage point delta). But high ratings alone don’t guarantee survival. Research shows the two most common reasons for failure remain: no clear market need, and running out of cash. Quality isn’t always enough.

Product Management’s Rise in the Martech Stack

Call it a silent breakthrough. Product Management has been hiding in plain sight. Amid modest net growth and record-high tool removals in 2025, one martech category quietly stood out. It didn’t explode in vendor count. It didn’t ride the genAI hype cycle. But it doubled its importance in practice. How?

Our data shows that Product Management tools — used to manage product lifecycles — have become quietly essential in modern martech stacks. Despite a stable number of vendors, their actual presence in stacks nearly doubled over the last decade, from 23% before 2020 to 42% after. That’s the largest leap in stack prevalence across all 49 Martech categories!

That’s not all. The Product Management category also showed the fastest year-over-year improvement in G2 ratings across the entire landscape — up 3.2%, compared to a global average of just 1%.

Tools like Jira, Aha!, Pendo, and Productboard are no longer fringe additions — they’re becoming core parts of how marketers and ops teams build and manage martech systems. These tools support the full product lifecycle: roadmap planning, backlog prioritisation, onboarding flows, digital adoption tracking, UX insights, and even co-browsing features.

It’s a subtle signal, but one that matters. These tools are no longer just for developers. They’re now essential for marketing teams building their own martech in-house. They’re changing the stack from the inside out.

Welcome to the rise of the Hypertail — a world where brands don’t just buy martech, they build it. Low-code and no-code platforms empower teams to assemble tailored internal solutions. These tools are often invisible externally, but deeply embedded within companies. And with every new internal product comes the need for proper lifecycle management.

Brands are becoming builders. And commercial Product Management tools are the backbone of this shift. This isn’t just a breakout success — it’s a signal of where martech is heading: toward more customisation, more internal development, filling in the gaps in their stacks, quick experimentation when needed, building bespoke solutions for brand-specific experiences, and more experiences managed like, well… products.

ALSO READ: Composability is Not a Strategy, But a Daily Reality