Consumers Are Not Shying Away From Premium For Quality

Due to changes in customers’ needs following the pandemic, the business model once proven for the region is no longer relevant. Announcing the launch of its comprehensive new report, written in collaboration with NielsenIQ, an Advent International portfolio company, Bain & Company Middle East highlights how companies operating in the Gulf Cooperating Council (GCC) have […]

Topics

Due to changes in customers’ needs following the pandemic, the business model once proven for the region is no longer relevant.

Announcing the launch of its comprehensive new report, written in collaboration with NielsenIQ, an Advent International portfolio company, Bain & Company Middle East highlights how companies operating in the Gulf Cooperating Council (GCC) have been facing unprecedented challenges in recent years.

“Companies are accelerating to meet the changing needs of consumers in the region,” said Mike Gerousis, an analytics leader for Saudi Arabia, Africa & Levant at NielsenIQ.

“Those that make the best-informed decisions and take a systematic and rigorous approach to turning the flow of data into profitable growth, will be the ones that outperform.”

Source: Bain

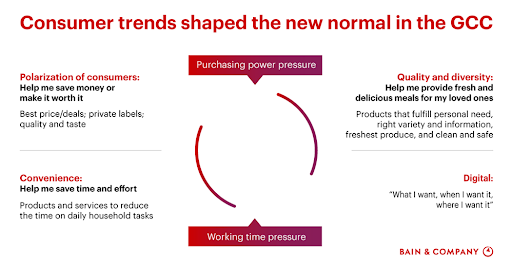

A significant slowdown in market growth has led to an intense fight among players to gain market share. The global rise in raw materials and transportation prices, in addition to a structural increase in the cost of doing business in the region, has put Fast-moving Consumer Goods (FMCG) companies’ margins under significant pressure.

As customers continue to evolve, digital is playing a key role in influencing consumer behaviour and changing purchasing habits, with more buyers preferring to shop online and at their convenience.

The research looks at the type of conversations consumers are having online. This is based on data that categorised 1.4 billion posts over the last three-year period across Twitter, online forums, reviews, and blogs: covering the US, Saudi Arabia, UAE, and Egypt.

“Customers in the region have changed: conscious consumers are optimising their budgets without compromising on quality. Moreover, according to our research, more than 60 per cent in the UAE and Saudi Arabia are willing to put a premium for quality. It is undeniable that the pandemic has made convenience paramount that shoppers are willing to pay extra for it,” said Faisal Sheikh, a partner in Bain & Company Middle East’s Consumer Products and Retail Practices.

With today’s customers willing to put a premium for quality and convenience, it is imperative that companies recognise and understand these changes and adapt approaches to maximise opportunities in this new environment.

“The pandemic has accelerated the rise of digital beyond merely looking for information. The FMCG eCommerce market has nearly doubled in the past three years. Nearly 50 per cent of shoppers in the UAE have visited an eCommerce site in the past seven days, a significant increase from last year,” said Cyrille Fabre, Head of Bain & Company Middle East’s Consumer Products and Retail Practices.

A significant slowdown in market growth has led to an intense fight among players to gain market share. The global rise in raw materials and transportation prices, in addition to a structural increase in the cost of doing business in the region, has put Fast-moving Consumer Goods (FMCG) companies’ margins under significant pressure.

Moreover, the research conducted by Bain & Company and NielsenIQ last year shows that trends in GCC consumer behaviours are broadly similar to the US. Consumers in the region care about health, affordability, and taste; they are though more satisfied by convenience and eCommerce but less satisfied with taste and freshness.

If you liked reading this, you might like our other stories

5 Ways to Harness the Power of Website Personalisation

Companies Face A Significant Cultural Pivot