When Supermarkets Turn Super-Tech Savvy

Grocery stores are having a moment. Leading brands are focusing on blending virtual experiences through contactless payments, smart shopping carts that make recommendations, and using robots to automate online orders. Best Buy CEO Corie Barry, in a company-wide earnings call last month, shared how the brand is looking to optimise its workforce, reimagine its physical […]

Topics

What to Read Next

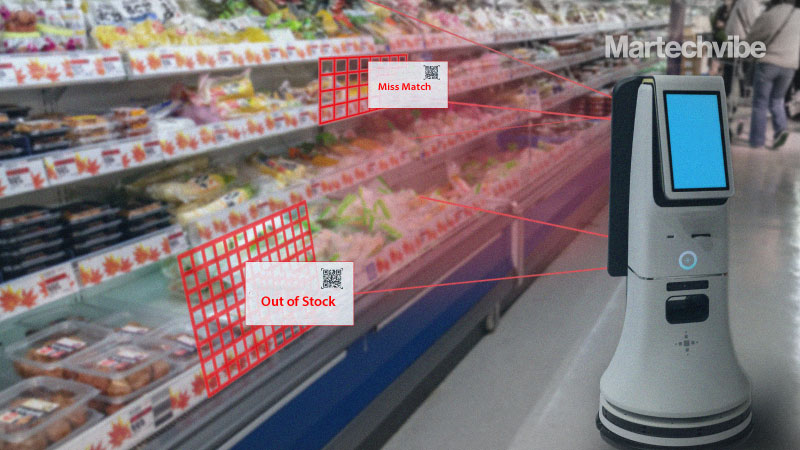

Grocery stores are having a moment. Leading brands are focusing on blending virtual experiences through contactless payments, smart shopping carts that make recommendations, and using robots to automate online orders.

Best Buy CEO Corie Barry, in a company-wide earnings call last month, shared how the brand is looking to optimise its workforce, reimagine its physical presence, and make investments to provide a better, more seamless shopping experience. The competition is tougher than ever, as customers are demanding more tactile options online and more convenience in-store.

In the last two years, Best Buy has invested in developing virtual stores because of the rise of customers interacting via phone and chat during the pandemic. The virtual stores operate via a small in-house staff and offshore call centre agents. Barry said the company is already seeing results — doubled revenue from these interactions compared to Q1 last year.

The company is also looking to continue reshaping its brick-and-mortar stores, looking at about 45 remodels for its store experience concept to bridge the gap between online sales and physical shopping. Online sales are responsible for 31 per cent of domestic sales, twice as high as pre-pandemic levels.

Earlier in April, GMG acquired the United Arab Emirates’ operations of French supermarket chain Géant from a company owned by Dubai Holding. This is GMGs first foray into food retail and it has big plans.

After all, it follows in the footsteps of retail giant Carrefour that rolled out its vision for the future of the industry in a cavernous Dubai mall in 2021. The trend in the region takes a cue from the changing face of supermarket retail in the US.

Age of the shoppable fulfilment centre

Walmart continues to ramp up its supply chain capabilities. The company is keen on its fulfilment centres following a tech-first approach. These new facilities will employ 4,000 associates focused on jobs such as control technicians, quality audit analysts and flow managers. Plans include using the latest automation technology to provide online consumers — including members of the Walmart+ customer benefits program — with access to next- or two-day shipping on “more items than ever before”.

Blending online and in-store

In an attempt to make stores smarter, Albertsons Cos. has partnered with Veeve Inc. to pilot “intelligent” AI-powered shopping carts that will enable customers to ring up items as they shop and pay without going through checkout. Inspired by Amazon? Perhaps.

The smart carts use barcode scanning and computer vision to identify products as they’re added to or removed from the cart. It has a built-in scale that automatically captures the weight and calculates the price of unpackaged groceries, such as fresh produce. A touchscreen near the cart handle keeps a running total of the items added. When done, customers press the Checkout button on the screen and tap to pay or insert a credit/debit card using the adjacent payment device. The carts will roll out later this year.

An interesting feature includes turn-by-turn in-store directions to find items across the aisles. There is scope for more customisation. Customers feed in their mobile numbers so carts can pull up past information, make recommendations and keep track of loyalty points.

Payment made easy

Amazon is using its arsenal of solutions to target the supermarket experience from all angles. Earlier this week, it rolled out the Amazon One contactless payment system, which uses palm-recognition technology at Whole Foods Market. The technology uses custom-built algorithms and hardware to scan a person’s unique palm signature and speed up the checkout process.

Conclusion

Drones are still a part of the conversation. Walmart plans to roll out DroneUp drone delivery for online orders this year. It will impact six states, enabling the retailer to serve 4 million households via the service. But the more interesting conversation is taking place behind the scenes. Ocado Group, a technology provider for grocery stores, announced the acquisition of materials handling robotics start-up Myrmex Inc. Stores are looking to speed up intelligent asset handling systems and advanced software can be a critical differentiator.

If you liked reading this, you might like our other stories

Can CI Supercharge A Brand’s Content Strategy?

For The Marketer’s Book Shelf